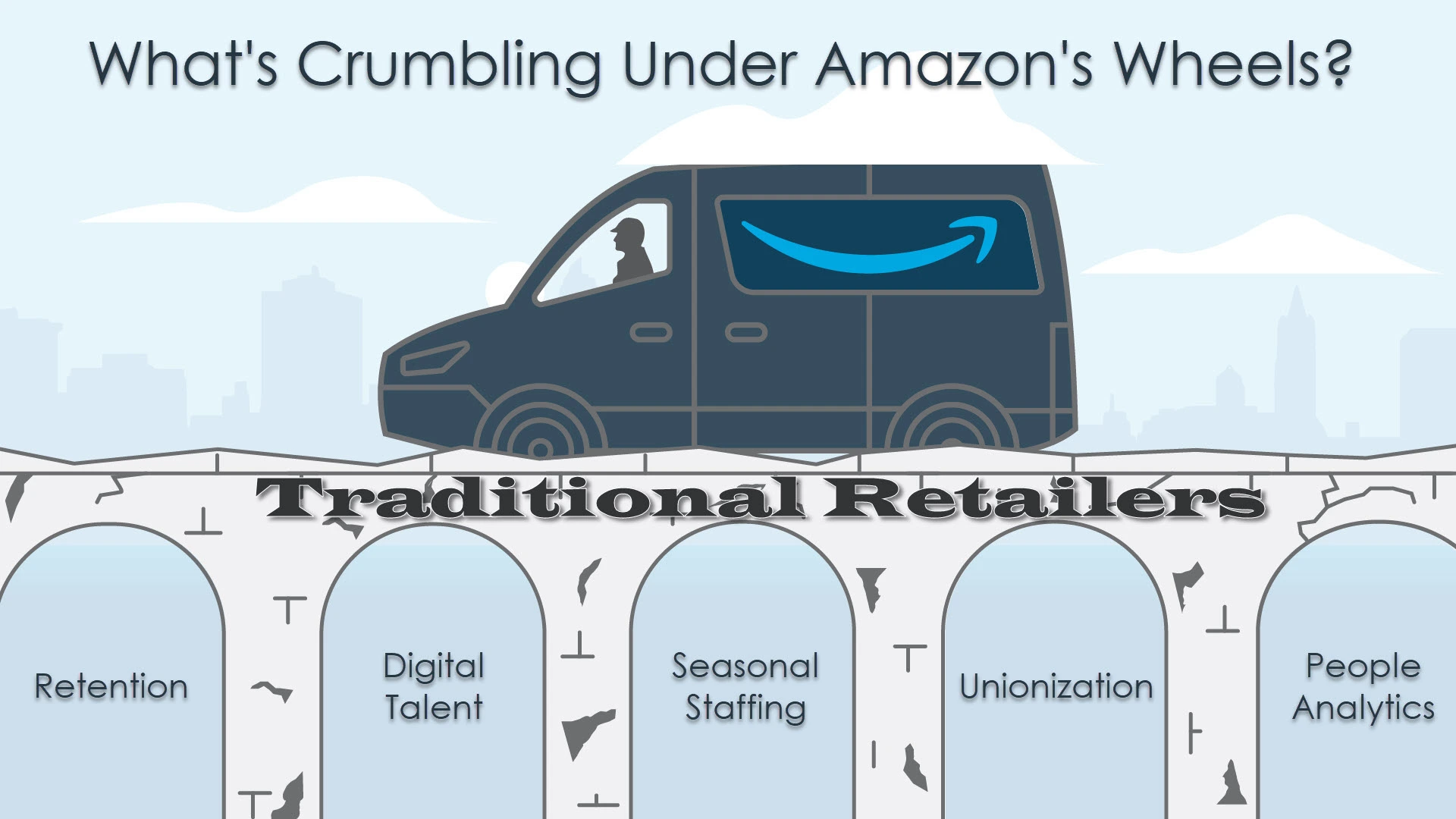

Retailers are riding a supercharged shopping cart full of change that has accelerated due to the pandemic and exacerbated by a one-company megatrend: Amazon. Amazon has over 10,000 people … just in Kentucky! That’s more than many retailers' entire organization. Accordingly, workforce issues are some of the biggest strategic challenges that the rest of US retailers face today.

People analytics, which aims to improve decisions involving employees, work, and business objectives, can deliver immediate impacts to retailers by bringing better data and insights to leaders at all levels of the organization who are making workforce decisions every day. Every retailer has sufficient velocity and scale to make them great candidates for the enormous value that can be captured through analytics, modeling, and insight generation.

People Analytics (PA): The application of data and insights to improve business outcomes through better decision making regarding people, work, and business objectives.

(Source: Explore the Power of People Analytics, Whiteman and Garbis, 2020)

Retailers once blazed the early trails of people analytics. In the first wave, from 2005-2015, big retailers were at the forefront. Unfortunately, the retail industry has mostly been surpassed in their people analytics prowess by peers in industries such as technology, financial services, and pharmaceuticals over the past decade. Perhaps too many of those analytics leaders moved out of retail and into other industries?

The pressure of today’s HR challenges in retail should inspire us to find the innovative spark once again. Retailers are in a great position to drive change in their organizations through the use of effective people analytics. Using people analytics technology, they can unlock significant value and show how workforce issues are understood and resolved. There’s really no choice but to apply the best decision-making practices possible toward solving the workforce challenges. The entire business model depends on it.

How might data help us to better

understand this issue?

How can we use data and insights in deciding the actions we should take?

Find out more by downloading our Retail Whitepaper

If you’re a human resources leader in retail, you may be inspired to rise to these challenges by applying people analytics to get the most value from your workforce data.

Amazon has been rolling over traditional retailers, capturing market share and exacerbating workforce challenges.

Challenge #1: Workforce Retention Is Not Just A Stores Issue Anymore

Retail has always had high turnover rates, but the truly eye-popping annual rates of 100%+ were limited to the store locations. These rates were treated as an accepted fact, a cost of doing business, and an operational challenge for management. In the past, only modest efforts were made in response to turnover, such as faster training to decrease time-to-productivity, recruitment automation to decrease open rates, and better benchmarking of prevailing local wages through labor market analysis.

Now warehouses and distribution centers are exhibiting turnover rates that rival the stores. Turnover rates in DCs and warehouses historically ranged from 30-40% annually. Today, retailers see figures approaching 100% or more. Wow!

In the meantime, store turnover has remained persistently elevated.

In response to this challenge, retailers have adopted a “hole plugging” approach that involves ramping up recruiting resources to backfill departing employees. The analogy to a draining bathtub fits; the drain keeps opening wider, and stores keep trying to open the faucet further in response.

Retail hourly workers are leaving for wage increases in many cases, but they are also leaving for concerns such as scheduling practices, paid time off policies, Covid and other safety protocols, and career growth opportunities. And the competition across big box retailers is being compounded by Amazon’s exploding demand for workers to fill its massive warehouse expansion.

People Analytics to Consider for Workforce Retention:

- New Hire Failure Rate. This metric involves calculating the portion of hires that do not last for 30 or 60 days at a given location, district, region, or across the total chain. Analysts would then explore “hot spots” and address the causes to improve recruiting sources, selection and evaluation criteria, onboarding processes, etc.

- Drivers of Turnover. Advanced analytical methods can help to determine the key drivers of turnover for stores and warehouse locations as well as up through the organizational hierarchy.

- Cost of Turnover. This metric helps HR teams calculate the cost to replace an average store or warehouse worker. Analysts should provide this information to leaders to ensure that these costs can be used in informing turnover reduction strategies.

- Cluster Analysis. This type of analysis helps to determine if there are groups of similar locations that have significantly different turnover rates. HR retail teams can then conduct qualitative interviews to discover best practices that can be tested in other locations.

Challenge #2: The Digital Talent Squeeze

The competition for digital talent seems to be growing more fierce every day. Talented developers, software engineers, product managers, and data scientists are moving between a wide range of industries and in/out of start-ups. Most significantly, Amazon, Google, Apple, Facebook, and Microsoft are swooping up talent by the truckload, bidding up salaries and emptying the shelves of more cost-conscious retailers.

The competition is so unrelenting that newly-hired digital talent is even being coaxed away between their offer acceptance and their start date. Wage compression is a significant concern as starting pay for highly-prized new hires approaches that of their more experienced peers and even their leaders.

The impact to retailers extends beyond the costs and frustrations of hiring and losing of new hires. Constantly open positions impede progress on digital innovation that retailers desperately need to remain competitive, such as customer-facing solutions that meet changing shopping patterns and automation in the supply chain and stores.

As retailers struggle to fill these digital roles, they are becoming more open to remote and location-flexible talent. This is providing them with a wider talent pool to recruit from, but retailers may find it difficult to manage these exceptions as they return to physical offices when the pandemic subsides. Retailers who push too aggressively on a return to the office could lose the talent that they worked so hard to secure. Or they may half-knowingly end up with a two-tier policy where remote work is only available to those with rarified skills.

People Analytics to Consider for the Digital Talent Squeeze:

- Internal Mobility Rate. This metric involves calculating the rate at which the digital talent moves into different roles. Stagnant pockets of ‘hoarded’ talent should raise concerns since that talent will eventually find opportunities outside (rather than inside) the organization.

- Recruiting Funnel Analytics. HR retail teams should identify the phase of the recruiting process where the most-qualified talent voluntarily drops out of the candidate pool. Within this broader withdrawal rate analysis you can look at the rate of offers being declined. There’s also plenty of value in diagnosing where the speed of the recruiting process can be improved.

- Retention Surveys. Develop surveys that create a deeper understanding of the factors that keep critical digital talent in their roles and get specific data to help learn if your employee value proposition (EVP) is clear and compelling for talent in key roles.

Challenge #3: Seasonal Staffing Models May Be Broken

In retail, the holiday season accounts for about 20% of annual sales, but occur during a 10% slice of the calendar. For roughly five weeks, every aisle and sub-aisle gets clogged with stacks of TVs, toys, and gadgets. Every register light is blinking and joyful music plays in stores. This is shopping nirvana, and retailers are at the center of everyone’s life. But staffing up to deliver on this experience is becoming more and more difficult.

Some retailers have quantified lost sales due to their inability to staff at necessary levels. The tight labor market is not just due to competition in the mall or across the parking lot. Changing shopping patterns have forced retail warehouses to hire incredible numbers of temporary workers for the holidays. Limited supply and high demand forces temporary worker wages to increase, and now its not uncommon for a temporary seasonal worker to be enticed to another retailer during the short holiday season.

So the seasonal staffing model that has worked for so many years may have finally broken. It may be impossible (or cost prohibitive) to find and ramp up the number of workers that are needed in such a short period of time. Rather than increasing recruiting efforts or recruiting earlier, some retailers are experimenting with more durable, lasting relationships with temporary workers. An “occasional” or “intermittent” employee type could keep workers active in the HR system if they work a certain minimum number of shifts within a certain period of time.

There are many advantages to “occasional employment” that address the challenge of holiday staffing. Retailers can benefit from decreased recruiting costs, reduced paperwork, faster onboarding and time-to-productivity, higher retention rates, and more experienced customer service. Naturally, there are some costs associated with keeping more active employees on the books. If an occasional employee works just one shift per month, then that employee will probably be less productive than a full-timer on a per-hour basis. However, when the holiday season arrives, that occasional employee will be better prepared and more reliable, reducing the overall staffing costs of the store.

An effective “occasional employee” strategy may require a change to a more flexible shift bidding and selection system. It’s also worth considering whether incentives can be created to encourage more hours. In ride sharing apps like Uber, surge pricing is built into the system. Perhaps there are surge wage accelerators for certain shifts?

People Analytics to Consider for Seasonal Staffing:

- Seasonal Staffing Rate. Retailers can calculate the increase in staffing, including both headcount and total hours worked) that each store or warehouse has experienced.Some locations will have more hours from seasonal workers than others. Focus on where the biggest opportunities for impacts are.

- Seasonal Staffing Rehire Rate This metric helps to determine how successful a retailer has been at re-recruiting seasonal workers. Ideally, rehires should be associated with lower recruiting and onboarding costs and higher retention rates. This measure informs efforts to sustain relationships with seasonal workers outside of peak periods.

- Seasonal Staffing Cost Analysis. Retailers can develop a comparative cost model for sustaining “occasional” workers with the current seasonal staffing model. This foundational measure can lead to a cost-effective and timely staffing model alternative.

Download the Whitepaper to Share with Colleagues

Challenge 4: Unionization

A labor relations leader at a large global firm once said, “No site ever got a union that didn’t deserve one.” His point was that unionization is a direct result of management’s failure to provide to workers the things they value most. In retail, workers appear to value:

- Wages that can sustain a worker who is working full time

- Transparent and timely scheduling practices, including schedules being published with sufficient and consistent advance notice.

- Pay for shifts that are cut short due to low customer or warehouse volume

- Acceptable policies and practices for bathroom breaks

- Limits to scheduling beyond stated availability or short-notice extra hours;

- Participation in paid time-off policies;

- Career advancement opportunities

It’s notable that most of these items are management practices and policies that have no direct additional costs.

Recently, we’ve witnessed some high-profile unionizations, including one Amazon warehouse (out of 110 total) and eight Starbucks stores (out of 15,000 total). These unionizations have sent shock waves through retailer headquarters. Many more union drives are currently in progress across the industry.

In response, retail leaders are looking back through their aging “union avoidance” playbooks. Many of these are leaked to the public and are somewhat unflattering for their brands.

There is a positive side to the story. The desire to unionize indicates that workers want to keep their jobs and do not want to quit outright. Unionization, therefore, is an opportunity for the retailer and their workforce to align on their shared and individual values and desires. Unionization drives are also signals that there may be an issue with the quality of the front-line management, and possibly the broader company culture and policies.

The retail industry is built on the idea of scale, where each store or warehouse is running the “same play” with minimal variation. Retailers are not well-equipped for managing an ever-widening range of policies across unionized and non-unionized locations.

Unionization presents significant challenges that include logistical and communications activities, negotiations at each unionized site, management of a portfolio of agreements, and the possibility of creating new benefits plans, training programs, and so on.

People Analytics to Consider Regarding Unionization:

- Site Stability Index. Retailers should create a “balanced scorecard” that covers all locations. The scorecard should include external information such as competitor openings, nearby union participation, local unemployment rates, and relevant legislative changes in that jurisdiction.

- Survey Analytics. Retailers should employ a continuous pulse survey strategy with appropriate sampling and rotating questions. This information can be correlated with turnover, mobility, leadership stability, manager performance, ombuds claims, and a sales or productivity versus plan report.

- Union / Non-Union Analytics. Retailers can learn from analytics that compare similar stores along union vs. non-union dimensions. Navigating complicated waters like this requires good information.

Challenge #5: Making Data-Informed Workforce Decisions

Beyond being a bit circular in the context of this paper, this last challenge should be considered very real and concerning. Every retailer with over 10 stores has the volume and velocity of people data in their systems to support data-informed workforce decisions of HR and business leaders. Each store and warehouse leader should have basic workforce data and analytics that are a couple of clicks away. Additionally, those leaders should be expected to use data and insights when making workforce decisions.

It is not a minor undertaking to change the decision-making fabric of a large organization. There are multiple levels of the organization involved in this type of change, and naturally the right tools and support are essential.

Starting at the top, the C-suite must set the expectation by integrating data into workforce decisions in ways that are visible to their teams. CHROs need to promote and hire HR retail leaders with analytical aptitude and curiosity. They need to drive change into their own function and groom HR business partners who truly shape the business. This is impossible without integrating people data and providing vehicles for sharing it.

Organizations that have done this right have built a People Analytics Center of Excellence or similar sub-function within the Human Resources department. But the people analytics COE is not simply a reporting or HR tech team. The people analytics team is dedicated to driving better, more data-informed talent decisions at all levels of the organization through content, products, insights, and advanced analytics.

Data is the foundation of any people analytics COE. It is crucial that data from multiple HR and non-HR data sources is integrated to create a high-quality data asset.

Maturity in people analytics should be considered in organic, non-linear terms. You should not plan to perfect the data first, then proceed to reporting, then to analytics, as you may see in a Gartner maturity model. Instead, first gather as much data as you need to create the content and analytics that will generate the most decision-making value for the organization. Then repeat the process for additional decision domains.

People Analytics Questions to Consider for Workforce Decisions:

- Which Data, Where, and How? Evaluate your company’s top priorities to determine what data is necessary to improve talent decisions. Locate both the HR and non-HR data required to inform those decisions. Explore how these multiple sources can be integrated. Determine which data sources are easily integrated and which integrations require heroic efforts.

- The Capabilities Ask how capable your HR function is in leveraging data for talent decisions. Ask if your business leaders are prepared to do the same.

- The Tools. Determine if a visualization and reporting platform is available to extend people analytics content across the entire organization. Is it flexible enough to accommodate our needs as they evolve?

The retail industry is facing a dramatic inflexion point in its ability to make brilliant talent decisions that propel profit growth, reduce risk, and deliver an incredible employee experience in which people thrive. The key challenges of HR in the retail sector cannot be understated.

The next era of people analytics for the retail industry is now – and you are here to lead it. We’re looking forward to exploring this with you.